The Pursuit of Happiness

As many of you know, I was born and raised in Alberta, Canada. While I feel incredibly grateful for the country to which I was born, I feel even more blessed that I now live in America (and it’s not just because I’ve exchanged my snow shovel for a surfboard - although it certainly helps). What I truly love about America is that its purpose aligns perfectly with humanity’s, which I believe is this: Life, Liberty and the Pursuit of Happiness (see the Declaration of Independence).

It is this pursuit of happiness to which I want to share in more detail. Studying happiness, and the pursuit thereof, has been a hobby of mine; and to me, Financial Planning at its purest most noble form is to assist with a person’s ability to pursue happiness. However, you may be surprised to discover what the research has shown from where people ultimately derive happiness.

Much of what I read was from Dr. Martin Seligman’s research, an American psychologist who focuses his research on happiness. Instead of researching psychological disorders (which is noble), he analyzed those that were thriving and consequently derived what he calls the five key elements of psychological well-being and happiness. These five core elements are Positive Emotion, Engagement, Relationships, Meaning, and finally Accomplishment (PERMA). You can learn more here.

Below is a great description from the link above of positive psychology from Dr. Seligman:

“Positive psychology takes you through the countryside of pleasure and gratification, up into the high country of strength and virtue, and finally to the peaks of lasting fulfillment, meaning, and purpose.”

Here are brief descriptions of the five elements and how financial planning can help:

P – Positive Emotion

This isn’t merely pleasure but enjoyment. Pleasure is connected to satisfying bodily needs for survival, such as thirst, hunger, and sleep. Whereas enjoyment comes from intellectual stimulation and creativity. As Dr. Seligman describes: positive emotions include hope, interest, joy, love, compassion, pride, amusement, and gratitude. As described, the ways to build positive emotion includes spending time with loved ones, participating in hobbies you enjoy, or it can occur while listening to music or even when expressing gratitude.

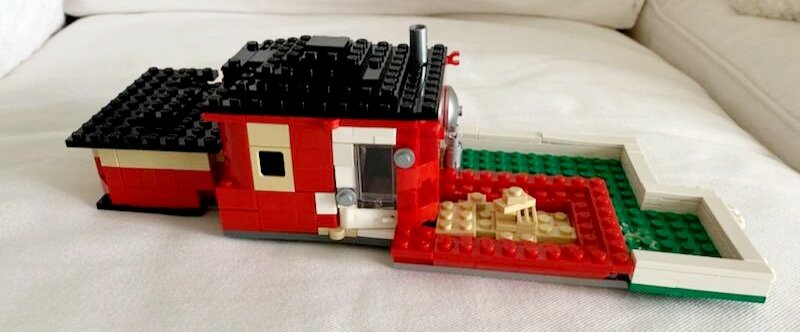

My middle son Conway is somewhat of a master with Legos. He comes up with some rather remarkable creations (see below). These activities provide far more positive emotion than if he merely watched The Mandalorian on Disney+. While watching Mando is a good time, it’s not nearly as fulfilling to him.

How Financial Planning can help — When I sit down with clients, we discuss their values and what they would like to accomplish in life. With this perspective I design and implement financial strategies to help them achieve their goals. Spending time with family or having time to pursue certain hobbies comes up often in these discussions and our subsequent planning.

E – Engagement

The second element is engagement and can be best described in the moments you experience flow or a state of unconsciousness. This is best explained in a remarkable book entitled Flow, written by psychologist Mihaly Csikszentmihalyi, who describes these "optimal experiences". During flow, people typically experience deep enjoyment, creativity, and total involvement with life.

What I found remarkable about the state of “flow” is that it occurs regardless of one’s race, gender, country of origin, socioeconomic class, or any other differentiator for that matter. Instead, it occurs when you take on something where your innate skillset is challenged that requires cognitive investment. At these moments you become absorbed in an activity and lose sense of time. Creating and playing music, wood working, and solving challenging puzzles are a few examples.

How Financial Planning can help — When I help clients with setting intentional goals regarding engagements where they currently find “flow”, I am then able to create plans to carve out the time and provide the resources, allowing them to pursue the activities which produce these optimal experiences. Without this intentionality, life happens regardless; but with intentional plans and follow-up, activities that produce optimal experiences can happen with more regularity.

R – Relationships

Maybe the most obvious component to happiness is one’s relationships with loved ones. As we all know, great relationships require consistent effort. I’ve heard it said “How do children spell love? T-I-M-E.” Enjoying quality time is critical for any relationship.

In my own experience, my relationships have been enhanced when I participate with my friends and family in new experiences. When I look back at my fondest memories, they often include a family trip. For example, when I asked my kids recently what memory stands out the most from the crazy year of COVID, they immediately mentioned swimming in Crater Lake.

Of course, familial relationships do provide challenges, which is why George Burns's quote is so good: “Happiness is having a large, loving, caring, close-knit family in another city.”

How Financial Planning can help — Money well managed can make relationships better. Money poorly managed can make relationships worse. I saw this with my own parents’ divorce which was caused primarily by their divergent perspectives on money. But money can also help provide incredible experiences with loved ones. I’ve road tripped with family down the California coast, taken my in-laws to see the wonders of Canada, and met family on the other side of the world (Thailand). Those collective experiences have provided some of our best memories which have strengthened our relationships.

M – Meaning

This component of happiness is believing in something bigger than yourself. For many people, religion and spirituality provide meaning. However, this can also be provided through working for a good company, volunteering, or being part of a cause or movement, like Greenpeace.

How Financial Planning can help — Proper planning can help amplify your financial and non-financial contributions to causes or organizations that you are passionate about. Examples of amplifying financial contributions include Qualified Charitable Distributions from your RMDs where you donate your RMD to a qualified charity and receive a tax deduction in the process. Other examples include Donor Advised Funds while more complicated strategies would include Charitable Trusts. From a non-financial contribution prospective, financial planning can show some clients that they are able to retire earlier so they can volunteer with the organizations they are passionate about.

A – Accomplishments

Having accomplishments in life is important; it requires that we push ourselves to thrive and flourish. As I like to explain, if you spent the next 6 months preparing for and completing a marathon you would feel much happier than if you spent that same amount of time on social media instead. Accomplishments can really drive life satisfaction and fulfillment to the highest heights.

How Financial Planning can help — How much planning can help ultimately depends upon what a client wants to accomplish. While much of what a person accomplishes resides within their own control, financial planning can help by designing and implementing financial strategies that aid with the critical resources of time and money which can help with one’s accomplishments.

Do You Actually Need Money to be Happy?

Most Americans would think that money is a requisite component of happiness, yet money isn’t specifically mentioned in any of the five components that Dr. Seligman discovered. However, it would be wrong to dismiss the notion that money isn’t completely necessary, because money can help provide the conditions that will allow one to obtain happiness. As I often share in my financial literacy classes: while money cannot buy happiness, a lack of proper money management can create conditions of misery.

This was further shown in a recent Bank of America survey in which 2000 affluent Americans were asked what the most important measures of personal success were. Interestingly, the top responses were not financially focused, but rather Good Health (63%), Supportive Friends and Family (59%), followed by Stable Source of Income (51%) and Money to Maintain the Desired Lifestyle (47%)*.

In the end, Financial Planning is much more than managing money or helping you reduce your tax liability (although both of these are critical). Financial Planning is also about accountability to the values and goals that are most important to achieving happiness. They all work together. As I like to explain to clients: a) goals are the destinations of where you want to go, b) the financial plan is the vehicle to get you there, and c) investments are the engine that drive the plan forward to the goals.

I share this perspective with you because, to me, Financial Planning at its purest and most noble form is to assist with a person’s ability to pursue happiness. True financial planning will identify these goals, as well as design and implement strategies to help you on your way to PERMA.

Thank you for taking the time to read my blog. I hope you found it helpful. If you have any questions regarding how I can help you identify your goals and ensure your financial plans are pointed towards the elements of happiness, feel free to reach out here.

Source: