The Cost of College and How to Pay for It - Part 1, Ep #15

June is the graduation season, so the episodes airing this month will focus on the cost of college and how best to pay for it. This episode of the One for the Money podcast focuses on your ability to pay for the college education of your loved ones effectively. Listen until the end when I share a great resource to help you further understand the expense of college and additional options on how to pay for it.

In this episode...

The magnitude of student loans [02:14]

College costs more now than ever [05:22]

Be careful with your choice of college [08:25]

Understanding the cost of college [12:52]

Preparing for college financially

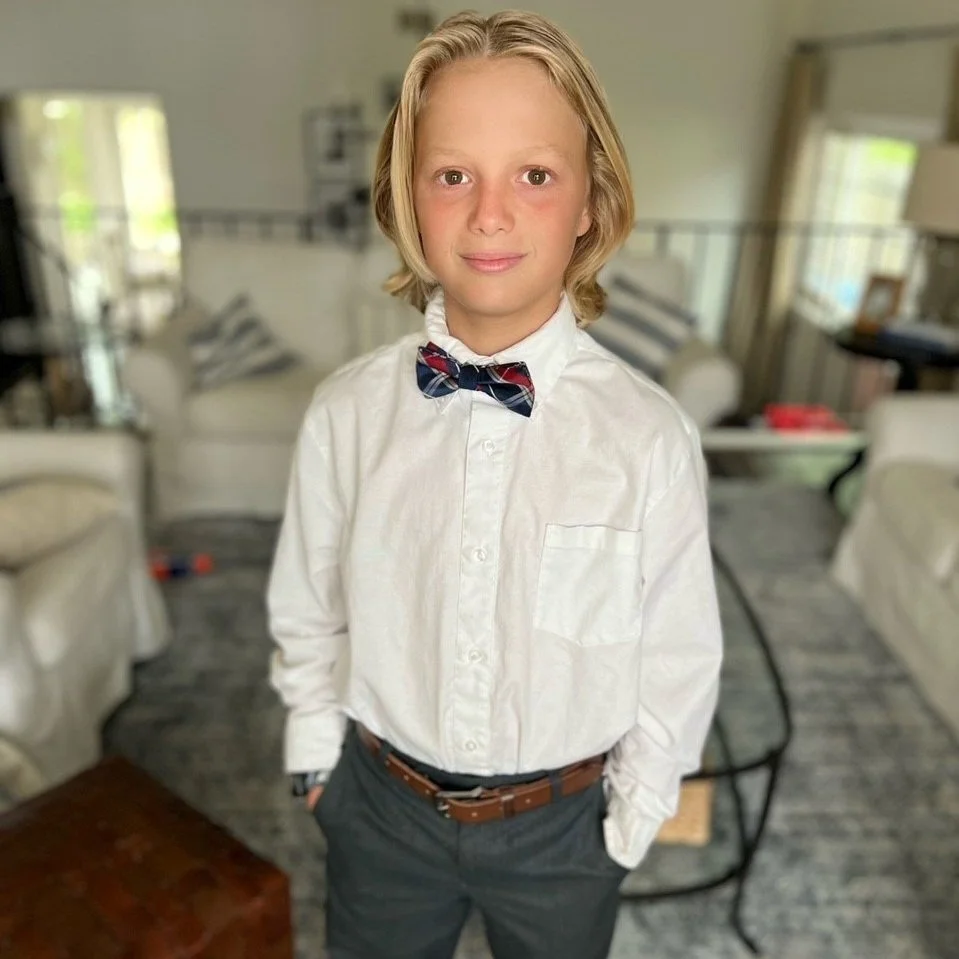

My wife and I can’t believe how quickly time has passed. Our oldest son is going into high school this fall, our middle son is going into middle school, and our youngest is starting the second grade. Sooner than we realize, my wife and I will begin working on their applications to college, which is a daunting project. If the college application process isn’t complicated enough, paying for college is an equally important and complex matter.

Our focus on the costs of college has increased for a good reason. The current level of student loan debt in the United States is $1.7 trillion. In fact, student loan debt is the second-highest consumer debt category behind only mortgage debt and is higher than both credit card debt and auto loans. These debts have a chance of leading to a future of financial crisis. The forgiveness of student loan debt may feature in the midterm elections. The government has already deferred interest, which has cost America over $100 billion.

The increasing costs of college

The cost of student loans has increased at twice the rate of inflation since 1983. The usual suspect is good government intentions to make schools more affordable. Despite the good intentions, these student loan programs caused a significant rise in tuition because the supply and demand mechanism became broken. Typically, prices are relatively held in check because consumers can’t afford steep increases. However, when people can borrow more and more money, tuition increases, and the federal government guarantees these loans.

College Planning Essentials

There’s a fabulous resource to help you further understand the cost of college and how to pay for it. College Planning Essentials is a resource provided by JP Morgan with a tremendous amount of relevant data. This tool provides the starting salaries achieved from certain degrees, with computer science having the highest starting salary, followed by engineers. It would seem that the STEM programs are great for future earning potential. This resource also provides intriguing facts about athletic scholarships and what they cover, which isn’t as much as you might think.

College Planning Essentials also provides a breakdown of expected family contribution. That’s a formula that colleges use to determine how much they will charge you. Unfortunately, the sticker price at a college isn’t the same for all families and instead is based on expected contributions. The resource compares various college saving vehicles, the benefit of 529s, and a host of other information. Check it out to learn more about the expense of college and how you can make well-informed decisions about those costs.

Prior to investing in a 529 Plan, investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state's qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

Resources & People Mentioned

Student Loan Debt Statistics In 2020: A Record $1.6 Trillion

Bureaucrats And Buildings: The Case For Why College Is So Expensive

Connect with Jonny West

Connect with Jonny on LinkedIn

Subscribe to ONE FOR THE MONEY on

Apple Podcasts, Spotify, Google Podcasts

Audio Production and Show notes by

PODCAST FAST TRACK